According to Intent Market Research, the Precision Medicine Market is expected to grow from USD 30.7 billion in 2023-e at a CAGR of 11.4% to touch USD 59.3 billion by 2030. The precision medicine market is competitive, the prominent players in the global market include AbbVie, Amgen, AstraZeneca, Bristol Myers Squibb, Catalent, Eli Lilly, Gilead Sciences, Johnson & Johnson, Lonza, Merck, Novartis, Parexel, Pfizer, Roche, Sanofi, Takeda Pharmaceutical, amongst others.

As per Intent Market Research, the Precision Medicine Market was valued at USD 30.7 billion in 2023-e and will surpass USD 59.3 billion by 2030; growing at a CAGR of 11.4% during 2024 - 2030. The market is thriving due to the growing focus on genomic research.

Personalized medicine is an emerging practice that uses an individual's genetic profile to guide decisions for the prevention, diagnosis, and treatment of disease. Patient's genetic profile can assist medical professionals in choosing the right treatment or drug and delivering it according to the right schedule or dosage.

Growing Focus on Genomic Research is Fueling the Market Growth

The surge in genomic research has been fueled by advancements in technology, making genomic sequencing more accessible and cost-effective. Researchers and healthcare professionals are now able to analyze vast amounts of genetic data, uncovering associations between specific genes and diseases. This focus on genomics has not only enhanced the understanding of diseases at the molecular level but has also paved the way for the development of targeted therapies. The cost of genomic sequencing has dramatically decreased over the years. For instance, the cost of sequencing a human genome exceeded USD 100 million in 2001, but by 2021, it had dropped to approximately USD 1,000. This reduction has fueled a surge in genomic research as more institutions and companies engage in large-scale genomic projects.

Moreover, initiatives such as the ‘All of Us Research Program’ in the US aimed to gather genetic and health data from diverse populations. This comprehensive data provides researchers with a powerful resource to examine how genes interact with other factors like environment, lifestyle, and social determinants of health. By studying diverse populations, the program can address the historical underrepresentation of certain groups in medical research, leading to more inclusive and impactful findings.

The Precision Oncology Revolution and Decline in Mortality is Driving the Market Growth

Precision oncology has seen notable success, with targeted therapies showing efficacy in specific cancer subtypes. For example, drugs such as imatinib revolutionized the treatment of chronic myeloid leukemia. As of 2021, there was a reduction in the cancer death rate by 1.5%, marking a notable 33% decrease overall since 1991 and preventing an estimated 3.8 million deaths. This positive trend is primarily attributed to advancements in treatment. Notably, there have been rapid declines in mortality rates, averaging around 2% annually from 2016 to 2020, particularly evident in leukemia, melanoma, and kidney cancer. Additionally, lung cancer has experienced accelerated declines in mortality during this period.

Moreover, the development of immune checkpoint inhibitors and CAR-T cell therapies is driving the growth of the precision medicine market. For instance, in December 2023, ABelZeta Pharma and AstraZeneca have entered into a collaborative agreement for the joint development of C-CAR031, an autologous, armoured CAR-T therapy designed to target Glypican-3. This innovative therapy is specifically aimed at treating hepatocellular carcinoma.

In addition, Legend Biotech Ireland, has secured an exclusive global license agreement with Novartis. This agreement encompasses specific CAR-T therapies developed by Legend Biotech, targeting Delta-like ligand protein 3 (DLL3). Thus, these innovations showcased breakthroughs in cancer treatment during the forecast period.

Inhibitor Drugs Held a Significant Market Share in the Precision Medicine Market

The inhibitor drugs, primarily attributed to factors such as higher efficacy and the substantial number of commercially approved options. In addition, inhibitor drugs encompass a wide range of significant indications, including but not limited to oncology and rare diseases which will boost the segment growth. One notable example of inhibitor drugs in precision medicine is the use of Tyrosine Kinase Inhibitors (TKIs) in the treatment of certain types of cancer. TKIs work by inhibiting these enzymes, thereby blocking the signals that promote cancer cell proliferation.

For instance, Imatinib (Gleevec) is a well-known TKI used in the treatment of Chronic Myeloid Leukemia (CML). It specifically targets the BCR-ABL fusion protein, which is characteristic of CML. By inhibiting the activity of this abnormal protein, Imatinib helps to control the growth of leukemia cells, leading to a more targeted and effective treatment.

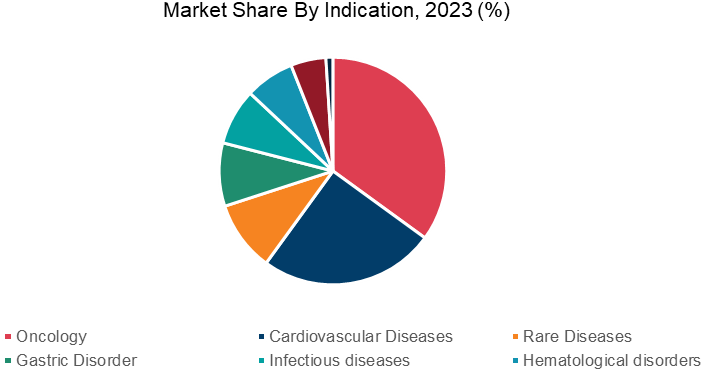

Personalized Medicine Plays a Pivotal Role in Oncology Treatment

The oncology sector held the predominant market share, driven by several factors including a rising number of approvals for oncology therapeutics designed for personalized or precision medicine applications. Additionally, the global surge in the burden of various cancer types has increased the demand for targeted or precision therapies, contributing to the prominence of oncology in the market.

Personalized medicine has significantly advanced the treatment of oncology by tailoring therapies to the unique genetic makeup of individual patients and their specific cancer characteristics. This approach allows for more targeted and effective treatment, minimizing adverse effects and increasing the likelihood of positive outcomes. One of the notable success stories in precision medicine is the treatment of Human Epidermal Growth Factor Receptor 2 (HER2)-positive breast cancer.

HER2 marketed as Herceptin, is a precision medicine drug designed to target HER2-positive breast cancer. This example underscores how personalized medicine in oncology, exemplified by drugs such as Herceptin, is revolutionizing cancer treatment by focusing on the unique genetic and molecular features of each patient's tumor. Such targeted approaches hold the promise of more effective treatments with fewer side effects, marking a significant advancement in the field of cancer care.

Source: Intent Market Research Analysis

North America to Dominate the Market in Terms of Revenue During the Forecast Period

North America has positioned itself as the dominant force in the market, and this dominance is anticipated to persist throughout the forecast period from 2024 to 2030. The expansion of the precision medicine market in this region is propelled by several factors, including the ready availability of cutting-edge technologies, essential diagnostics for precision medicine, and the presence of highly advanced infrastructure within hospitals.

The continuous introduction of innovative products by key players in the region serves as an additional driver for market growth. For instance, in April 2021, MCI Onehealth Technologies formed a strategic alliance with Ariel Precision Medicine to accelerate MCI's precision medicine and technology initiatives across clinical and commercial projects involving pharmaceutical, medical device, and life sciences companies. Similarly, in March 2021, the National Institute of Health (NIH) invested in the subsequent phase of a public-private partnership dedicated to advancing precision medicine research for Alzheimer's disease. The escalating number of partnerships dedicated to advancing precision medicine across various diseases is expected to make a substantial contribution to the country's market growth.

The Market is Highly Competitive with a Presence of several major players

The market is characterized by intense competition due to the presence of numerous international and domestic players. The precision medicine market, in particular, is dominated by key players such as AbbVie, Amgen, AstraZeneca, Bristol Myers Squibb, Catalent, Eli Lilly, Gilead Sciences, Johnson & Johnson, Lonza, Merck, Novartis, Parexel, Pfizer, Roche, Sanofi, Takeda Pharmaceutical, amongst others.

Prominent players in the precision medicine market are actively engaged in advancing their positions through the development and introduction of innovative personalized medicine products. Established companies in the industry are pursuing key mergers and acquisitions activities to fortify their foothold in the competitive market landscape.

Precision Medicine Market Coverage

The report provides key insights into the precision medicine market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyses key players and the competitive landscape within the market. The report offers the market size and forecasts for the precision medicine market in value (USD billion) for all the above segments.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 30.7 billion |

|

Forecast Revenue (2030) |

USD 59.3 billion |

|

CAGR (2024-2030) |

11.4% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

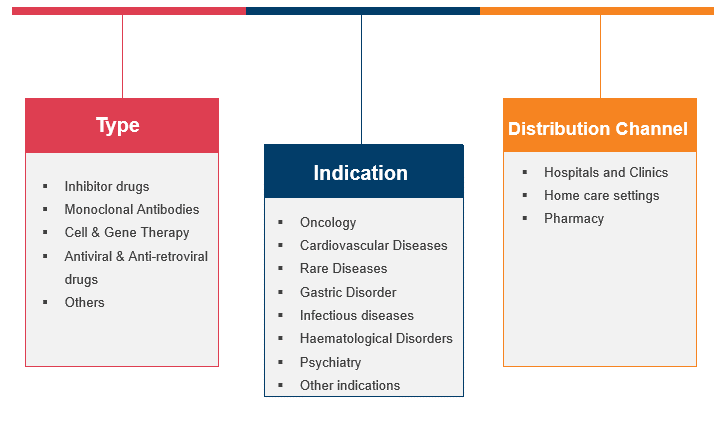

Segments Covered |

By Type (Inhibitor drugs, Monoclonal Antibodies, Cell & Gene Therapy, Antiviral & Anti-retroviral Drugs, Others), By Indication (Oncology, Cardiovascular Diseases, Rare Diseases, Gastric Disorder, Infectious Diseases, Hematological Disorders, Psychiatry, Others), By Distribution Channel (Hospitals and Clinics, Home Care Settings, Pharmacy) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

AbbVie, Amgen, AstraZeneca, Bristol Myers Squibb, Catalent, Eli Lilly, Gilead Sciences, Johnson & Johnson, Lonza, Merck, Novartis, Parexel, Pfizer, Roche, Sanofi, Takeda Pharmaceutical, amongst others. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Increasing Efforts to Characterize Genes |

|

4.1.2.Rising Emphasis on Genomic Research |

|

4.1.3.Advancement in Cancer Biology |

|

4.1.4.Advancements in Genetic Testing |

|

4.1.5.Rising Prevalence of Chronic Disease |

|

4.2.Market Growth Restraints |

|

4.2.1.Perils of Data Sharing |

|

4.2.2.Shift from Treatment-Based to Preventive Healthcare |

|

4.2.3.Rising Development Costs in Therapeutic Areas |

|

4.3.Market Growth Opportunities |

|

4.3.1.technological Advancements for Cell & Gene Therapies |

|

4.4.Pestle Analysis |

|

4.5.Porter’s Five Forces Analysis |

|

5.Market Outlook |

|

5.1.Overview (Industry Snapshot) |

|

5.2.Technology Analysis |

|

5.3.Supply Chain Analysis |

|

5.4.Value Chain Analysis |

|

5.5.Regulatory Analysis |

|

5.6.Ecosystem Analysis |

|

5.7.Patent Analysis |

|

5.8.Trade Analysis |

|

5.9.Trends/Disruptions |

|

5.10. Key Conference and Events |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Segment Synopsis |

|

6.2.By Type |

|

6.2.1.Monoclonal Antibodies |

|

6.2.2.Inhibitor Drugs |

|

6.2.3.Antiviral & Anti-retroviral drugs |

|

6.2.4.Cell & Gene Therapy |

|

6.2.5.Others |

|

6.3.By Indication |

|

6.3.1.Oncology |

|

6.3.2.Cardiovascular Diseases |

|

6.3.3.Rare Diseases |

|

6.3.4.Gastric Disorder |

|

6.3.5.Infectious Diseases |

|

6.3.6.Hematological Disorders |

|

6.3.7.Psychiatry |

|

6.3.8.Other Indications |

|

6.4.By Distribution Channel |

|

6.4.1.Hospitals and Clinics |

|

6.4.2.Home Care Settings |

|

6.4.3.Pharmacy |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Global Market Synopsis |

|

7.2.North America |

|

7.2.1.North America Precision Medicine Market Outlook |

|

7.2.1.1.US Precision Medicine Market, By Type |

|

7.2.1.2.US Precision Medicine Market, By Indication |

|

7.2.1.3.US Precision Medicine Market, By Distribution Channel |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.2.Canada |

|

7.3.Europe |

|

7.3.1.Europe Precision Medicine Market Outlook |

|

7.3.1.1.Germany |

|

7.3.1.2.UK |

|

7.3.1.3.France |

|

7.3.1.4.Spain |

|

7.3.1.5.Italy |

|

7.4.Asia-Pacific |

|

7.4.1.Asia-Pacific Precision Medicine Market Outlook |

|

7.4.1.1.China |

|

7.4.1.2.India |

|

7.4.1.3.Japan |

|

7.4.1.4.South Korea |

|

7.4.1.5.Australia |

|

7.5.Latin America |

|

7.5.1.Latin America Precision Medicine Market Outlook |

|

7.5.1.1.Mexico |

|

7.5.1.2.Brazil |

|

7.6.Middle East & Africa |

|

7.6.1.Middle East & Africa Precision Medicine Market Outlook |

|

7.6.1.1.Saudi Arabia |

|

7.6.1.2.UAE |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Volume Output Analysis |

|

8.3.Company Strategy Analysis |

|

8.4.Competitive Matrix |

|

9.Company Profiles |

|

9.1. AbbVie |

|

9.1.1.Company Synopsis |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.Analyst Perception |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.2.Amgen |

|

9.3.AstraZeneca |

|

9.4.Bristol Myers Squibb |

|

9.5.Catalent |

|

9.6.Eli Lilly |

|

9.7.Johnson & Johnson |

|

9.8.Lonza |

|

9.9.Merck |

|

9.10.Novartis |

|

9.11.Pfizer |

|

9.12.Roche |

|

9.13.Takeda Pharmaceutical |

Let us connect with you TOC

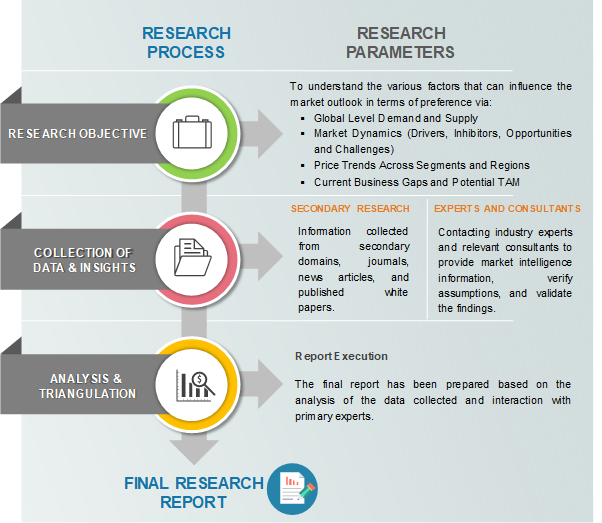

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

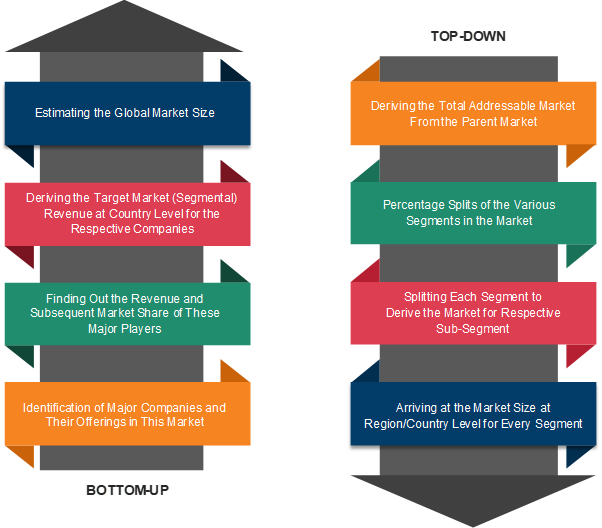

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats